There are currently over 775000 iPhone apps in the Apple Store, and that number grows daily. But they’re not all fun and games, or social play. You will find some useful financial apps available for the iPhone, which when used correctly, can help anyone make inroads towards financial literacy and progress. Here are five of the best.money apps for iphone

Keep track of where each of your hard-earned dollars go with the moneyStrands app for iPhone. You make a budget, and then enter your income and expenditures. The app keeps track of what you actually spend and compares it to your budget. You can track what you spend by category, giving an accurate picture of where your money goes. moneyStrands displays this information on graphs and pie charts, for quick reference. If you’re tempted to spend money on something that runs counter to your saving goals, this little app provides graphic motivation to help you make the best choice.

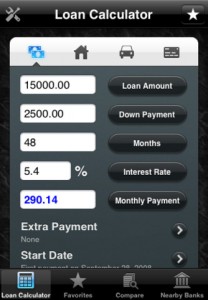

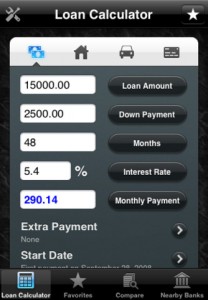

Loan Shark is an app that does the complicated interest math for you. You can use this for loans, home mortgages and credit cards. This smart app calculates how much interest you would pay based on the percentage amount, length of the loan and the monthly payment, along with a few other variables. You can plug different scenarios into Loan Shark to figure out which type of loan works best for your situation. It does the difficult work of understanding and calculating for you.

3. CheckPlease

Figuring out tips for dining out and hotel stays can be a trivial thing- and it can be a frustrating thing. CheckPlease calculates tip amounts for you, based upon the percentage that you choose. When you’re dining with a group of people, this app can figure out the bill and tip split. It works with several foreign currencies, for those who travel. Unlike similar apps, CheckPlease remembers your last setting rather than reverting to the original setting. This app saves you worry about whether your tip is too large or not sufficient.

This is a popular app that allows any one of us to accept credit card payment efficiently and securely. You don’t need to be a business owner to use from this app. Say you’re looking to sell an item on Craigslist, to a stranger. Would you rather take a chance on their check, or go the more secure route of taking their credit card? Square’s fees are less than what the major credit card companies charge. Plus, more established businesses are accepting Square transactions as a matter of course. This could be a financial wave of the future.

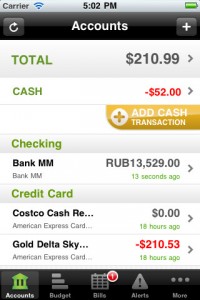

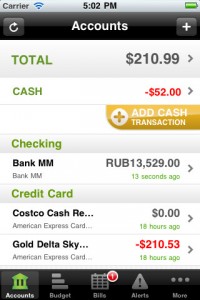

This is a quick and simple app that lets you track daily cash expenditures. It’s not as fancy or feature-laden as moneyStrand, (see above review), or similar apps, yet it is useful for times when you want a fast and easy place to record what you spend. You can enter the amount of money you want to spend over a specified time period, then watch the nifty “gasoline gauge” graphic move from Full to Empty as it tallies your purchases. It’s great, for example, on out of town trips when you’re on the go yet still want to stick to your budget.

Those iphone apps are just a start, as there are many more on the market and certainly a few that will fit your specific needs. Of course, they must be used regularly in order to do the work they are designed for. Most of us consider our iPhones to be must-have items that have the same priority as wallets and pocketbooks. Add a money app or two to go along with your credit cards and cash, and make financial planning a painless part of your everyday routine.

Chase Sagum is a blogger covering Financial topics specifically Credit Repair, around the web.

Check Out These Too:

- Top 15 Free iPhone Apps Top 15 free iPhone apps. Applerepo.com, The title of this article could also have been the best 15 iphone applications that you still don't have because you didn't know they…

- Troubleshooting Audio Books on Your iPod Recently, Friederike wrote into us to tell us about a problem she's having with her iPod and audiobooks. The problem Friederike is having is a very common problem among iPod…

- Best Apps to Get for Your iPhone 3GS Great apps are nearly everywhere for people that want to play games on their iPhone 3GS. From action iPhone games to social networking apps, or simply internet apps - there…

- Angry Birds App review One of the apps that you will probably have heard of for the iPhone and iPod Touch devices is Angry Birds. Since its release, the Angry Birds app has taken…

- Two of the Coolest Office Apps for the iPhone Yes, there's an app for everything. And when it comes to business apps and office apps, the iPhone has a whole world of them available. We have found two that…

- AppStart iPad App Review One of the most difficult things that you will have to think about when you first get an iPad is the apps that you are going to download for it.…

- iPhone, iPod Touch and iPad apps used more than TV It might seem like it wouldn’t be possible, but new research has found that the daily audience for people that are using iOS devices including the iPad, iPhone and iPod…

- Tutorial on How to Turn Off Automatic Download of… How to Turn Off Automatic Download of Apps on iPhone & iPad? - Applerepo.com, If you use the same Apple ID on multiple devices, apps automatically downloaded to all connected…

- Apple Launch Mac App Store As many of you will already know, Apple have launched some of the most innovative products that have been known in recent history. Their iPhone and iPod Touch device re…

- Simple Financial Management For iPod Touch Users: Pennies With a well-earned reputation as one of the best budgeting apps on the iPod Touch, Pennies can easily end up as a crucial component of your personal financial management. In…

- Why is My Cash App Not Opening Crashing on iPhone? Why is My Cash App Not Opening Crashing on iPhone? - AppleRepo, If you don't know cash app (cash + app) it's an app that allows you to send and…

- Best iPhone 8 Apps To Download Best iPhone 8 Apps To Download In 2017 - AppleRepo.com, iPhone 8 is the new sensation these days and there is a lot of buzz and talking around about the…

- Apps To Help You Diet And Lose Weight Apps To Help You Diet And Lose Weight. One of the main things that you need to think about if you are trying to get fit and lose weight is…

- Best Ipad Apps for Preschoolers Best ipad Apps for Preschoolers - Top 3 Best preschooler ipad apps Yeah, you heard it right, the tablet computer manufactured by Apple Inc. named iPad has also rooms for…

- Why the Apple iPhone Appeals to the Frequent Traveler There are many things that you can do on your iPhone that will both occupy your time and entertain you. There a number of games and iPhone applications that you…

- How to Turn Your iPhone Into a Braille Display Braille Display iPhone Tutorial - Applerepo, Braille displays are great for the visually impaired, but they're not as common as you might think. However, if you're looking for a way…

- The Find For Free There are all kinds of shopping apps out there that will each do a few different things for you. But The Find app for the iPod Touch takes all of…

- Apple Shows their Strength with Cash Apple has always been known to continuously work and improve their income and revenue and today that is increasingly evident through their abundance of cash. According to most recent reports…

- Qardio App for Iphone The qardio app for iphone is an innovative device that allows you to measure your heartbeat and record it in a safe manner. This device helps to monitor your health,…

- The Four Best iPhone Apps for Women When you want to truly girly-girl up your iPhone, here are the four best iPhone apps for women. iPeriod - Are you tired of marking up your calendar with all…

- Get Paid iPhone or iPod Touch Apps for Free There are tons of great free apps out there, and there are tons of great paid apps out there. The problem is when you're not interested in paying money for…

- Create Your Own Iphone And IPad App Create Your Own Iphone And IPad App. If you have had a great idea for the iPhone you do not have to be a programmer to make it happen. There…

- Free iPod Touch Apps for Gaming; Flight Tycoon Tycoon style games are not something that is new to the Apple devices and they have actually been around for many years on a variety of other consoles. Having said…

- How to Fax From iPhone for Free ? (Send and Receive) Did you know that you can receive and send faxes from all Apple devices running iOS 11, iPadOS 11 and beyond? Here, we discuss how to send and receive a…

- FREE GAMES FOR IPOD TOUCH Get iPhone Games for Free FREE GAMES FOR IPOD TOUCH - There are so many cool paid iPod touch or iPhone games in the iTunes apps store. Sometimes the apps…

- Apple App Store Significantly More Profitable than Android The Apple App Store has been the centerpiece of iOS's application distribution system. Millions of iPhone users worldwide download apps and other fun things from the app store every single…

- The Three Best Shopping Apps for the iPod Touch The iPod Touch is great for doing all kinds of stuff. But did you know that you can shop directly from your Touch, without ever opening the browser? All you…

- iPhone 3G Apps The iPhone 3G, which is the new model of the classic iPhone, offers state of the art performance and functionality that has brought about a new class of all purpose…

- Top Rated iPhone Apps So you're looking for only the very best iPhone apps? Of course you are, who isn't? And just so you don't have to go searching and searching through the App…

- How to Delete Apps on iPad: Permanently and Temporarily How to Delete Apps on iPad: Permanently and Temporarily Most of the time we download and save files – be it music, games, or videos, that we sometimes end up…